Contents

Home Refinance Rates Arizona View Rates. Learn More. Contact Arizona Central Credit Union by calling (602) 264-6421 or toll free at (866) 264-6421 to learn more about our refinancing options! 1 90 days to first payment is subject to credit approval and only valid on autos and motorcycle loans not already financed with Arizona Central Credit Union. First payment may be.

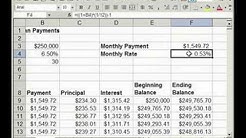

Additionally, the 15-year fixed mortgage rate was 3.27%, and for 5/1 ARMs, the rate was 3.66%. Check Zillow for mortgage rate trends and up-to-the-minute mortgage rates for your state, or use the mortgage calculator to calculate monthly payments at the current rates. The weekly mortgage rate chart above illustrates the average 30-year fixed.

View today’s mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and explore your home loan options at Bank of America.

Citibank Mortgage Refinance Rates Pick Your Rate Type. CitiMortgage provides both fixed and adjustable rate mortgages. Which one is right for you? The difference is that a fixed rate never changes, so you know exactly what your principal and interest payment will be for the entire length of your mortgage.

Check out the mortgage rates charts below to find 30-year and 15-year mortgage rates for each of the different mortgage loans U.S. Bank offers. If you decide to purchase mortgage discount points at closing, your interest rate may be lower than the rates shown here.

Check out the mortgage rates charts below to find 30-year and 15-year mortgage rates for each of the different mortgage loans U.S. Bank offers. If you decide to purchase mortgage discount points at closing, your interest rate may be lower than the rates shown here.

Compare today?s mortgage and refinance rates from Citi.com. View current mortgage rates on 30 year and 15 year fixed mortgages. Get a customized rate and.

MORT invests in mortgage REITs in the United States. we have recently seen a yield inversion where the short-term rate is higher than the long-term rate. As can be seen from the chart below, the.

Apr Vs Interest Rate Calculator Home Equity Rates Texas Monday Morning Cup of Coffee: Black Knight projects record-high home equity – Now, more than 40 million american mortgage holders have tappable’ equity available to them. If home prices continue to rise at or near their current rate of appreciation. of the University of.Online finance calculator helps you to convert Annual Percentage Rate (APR) to Annual Percentage Yield (APY). Code to add this calci to your website Just copy and paste the below code to your webpage where you want to display this calculator.

In addition, elevated Canadian household debts coupled with 5 interest rate hikes has made it challenging for Canadian banks to grow its residential mortgage portfolio. As can be seen from the chart.

The mortgage division was never a strategic growth area for the bank. With the Fed’s ongoing rate hike over recent years driving. It should be noted that the charts below capture the average loan.

Getty Images Credit Suisse CS, -0.75% and Citigroup CITI, -1.07% are moving back into a corner of the mortgage market where new home. billion of non-QM bond supply this year. This Bank of America.

Mortgage Rate History: 1971 to Today. Homebuyers who have recently borrowed fixed-rate mortgages have benefited from interest rates at historical lows. After reaching a high of nearly 19% in 1981, mortgage rates have steadily declined and remained in the low single digits.

Releases of note this week and next include the weekly chain store sales, oil/gas numbers, mortgage applications and jobless.

States, such as Kano, Akwa Ibom, Katsina, Kaduna, Taraba, Sokoto, Yobe, Zamfara, Oyo, Benue, Jigawa and Ebonyi, top the chart.